Dubai luxury home prices rose over 44% in 2021, more growth is expected in 2022.

A famous real estate quote by Will Rogers “Don’t wait to buy real estate, buy real estate and wait” translates to a long-term increase in the value of properties. This, which the Dubai real estate market has experienced post-pandemic.

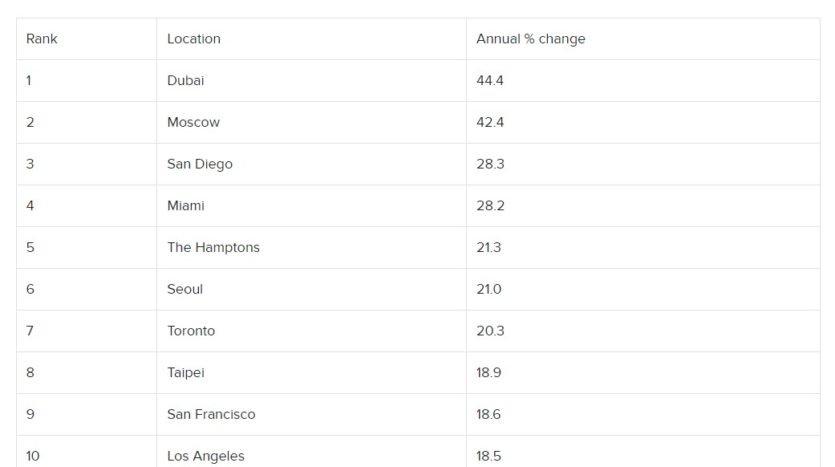

According to Knight Frank’s latest study released on Tuesday the 1st of March, luxury home prices in Dubai grew at the quickest rate among the world’s top 100 cities, increasing by more than 44% in 2021. Faisal Durrani, partner and head of Knight Frank’s Middle East Research explained that this result is as a continuous demand from the world’s wealthy which has fueled a dramatic reversal in the fortunes of Dubai’s residential market, with the authorities’ decisive handling of Covid-19 gaining worldwide investors’ attention. “And in the sentiment-driven market, this has helped to spectacularly mark the start of the city’s third property cycle,” he added.

However, Durrani explained that while the increase of 2021 is unlikely to be repeated in 2022, the upper end of the market still has an opportunity for growth in 2022 due to the scarcity of premium stock.

Nevertheless, the real estate consultancy has projected that the global luxury property growth will not slow down this year, and the rally will continue, with Dubai, Miami, and Zurich leading the way. In the post-Covid time, a large number of ultra-high net worth buyers flocked to the Dubai real estate market, and while their initial trips were fueled by the UAE’s handling of the pandemic, “their decision to purchase property in the Emirate has been fuelled by something entirely different. Dubai’s investments in world-class infrastructure, health, and education, coupled with the exceptional lifestyle and amenities, from the world’s best restaurants and hotels have helped transform the city into a destination that people want to own a property in,” said Andrew Cummings, partner and head of Prime Residential at Knight Frank Middle East

Additionally the global head of research at Knight Frank, Liam Bailey said “Far from running out steam, this year we will see the luxury housing boom endure. Dubai, Miami, and Zurich lead our 2022 forecast, with prime prices expected to end the year between 10 percent and 12 percent higher. Asian cities are expected to trail slightly, but even here, prices will grow,”.

In summary, the Dubai luxury home market is pointing in a positive direction for real estate investors. Buy real estate and wait, and see the increase in value as experienced by the Royal Park investors within the first 1-2 years of their purchase.

Are you looking to invest in Dubai luxury homes? Here are the top recommended projects with the potential for a rapid increase in value.